LVMH Board in Paris Reviews Pros + Cons of Tiffany & Co Acquisition

/LVMH’s board met in Paris Tuesday night, prompting Tiffany’s shares to close down nearly 9%. Concerns are mounting about the luxury market in general and the COVID-19 pandemic. The massive protests and looting connected to the death of George Floyd at the hands of Minneapolis police officer Derek Chauvin have also given LVMH pause about the future.

According to WWD, LVMH’s board is also concerned about Tiffany’s ability to cover all its debt at the end of the transaction, delayed by officials in Australia two months ago. The deal was scheduled to close mid-year.

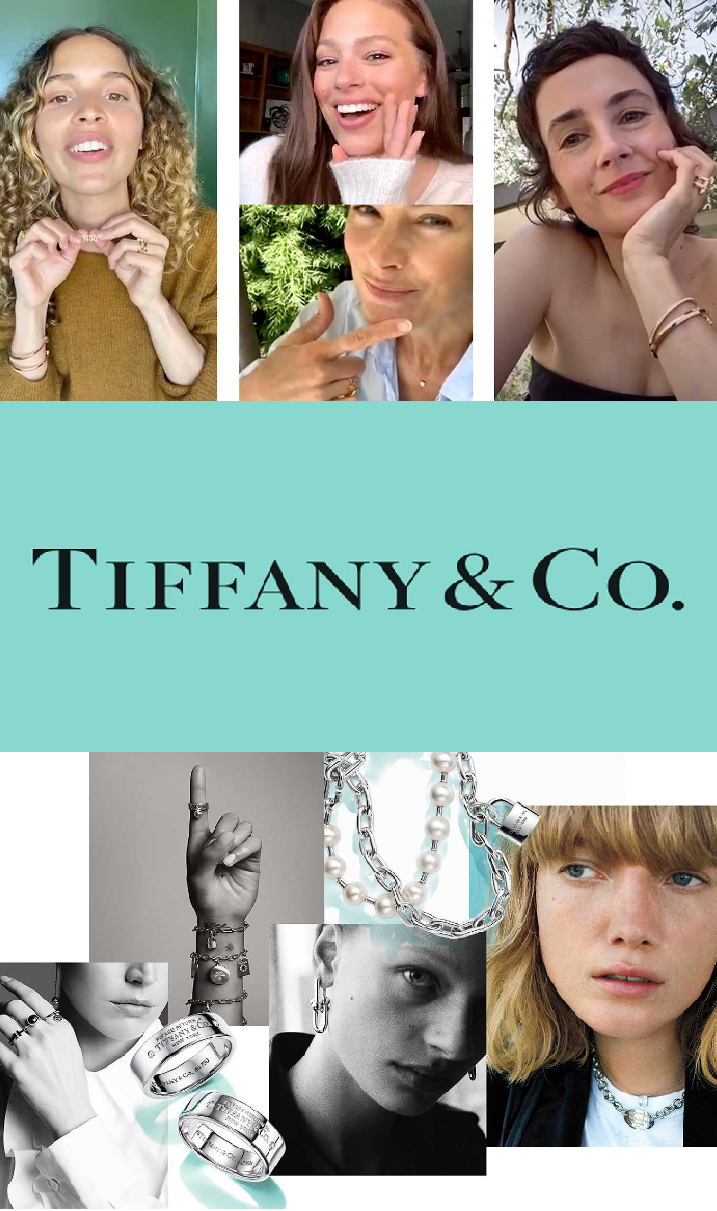

LVMH agreed to buy Tiffany in November 2019, in its largest acquisition ever with a $16.2 price tag. There is no coubt that Tiffany will be negatively impacted by all these factors, coupled by a nosedive in international tourist travel to New York and America.

AOC adds the additional factor of changing assumptions around consumption and the obligations of brands to their customers and society at large. In this case, Tiffany is comparatively well-positioned and very in sync with environmental, customer transparency, and ethical issues faced by all major brands in today’s post-COVID world.

We took up the topic of Tiffany last week, comparing them to Cartier’s comparatively modest commitment to these critical issues for successful brand-consumer relationships .