A Sobering Look at Burberry's Winter 2024 Campaign and Financial Winds

/Burberry rolled out a massive model and talent roster for its Winter 2024 campaign, lensed by Tyrone Lebon. Unfortunately, even the excitement-generating post-Burberry runway appearance of Agyness Deyn in the celebrating Britain campaign can’t stop the financial blood that Burberry is hemorrhaging so severely that the 168-year brand that left its listing on the FTSE 100 on Wednesday.

Arthur Willams shoots the hauntingly beautiful film, with creative direction by Daniel Lee.

Other models include Adwoa Aboah, Amin Lawal, Babacar N’doye, George Osborne, Henry Kitcher, Jude Furnivall, Lauren Theobald, Lila Moss, Lily Donaldson, Lina Zhang, Long Li, Maya Wigram and Nora Attal. / Hair by Shiori Takahashi; makeup by Ammy Drammeh; set design by Emma Roach

Burberry Delisted on FTSE 100

The reason Burberry left the FTSE 100, which showcases the 100 most valuable companies listed on the London Stock Exchange, is because it no longer qualifies for inclusion.

The slowdown in luxury spending in China has hit the entire luxury market, but Burberry is reeling. The fashion house is now valued at £2.23 billion ($2.93 billion), 56% less than it was eight months ago.

Simply stated, elevating Burberry’s aesthetic has not worked. The appointment of Joshua Schulman as chief executive in July suggests a change in direction — and not the kind a designer can repair.

Burberry has cycled through four CEOs in a decade, and Schulman arrives as the former CEO of Coach and Michael Kors.

Jonathan Kiman, a 12-year veteran of Gucci as CMO joins Burberry on September 9 as Chief Marketing Officer. Before Gucci, Kiman was Chief Brand Officer at Versace. Laura Dubin-Wander is joining Burberry as President of the Americas from OTB [Maison Margiela, Jil Sander, Marni and Diesel].

The Wall Street Journal notes that the appeal of taking a brand upmarket — the challenge Burberry has undertaken in recent years — is the profit margin. Exclusivity — including being in company-owned stores and only exclusive department stores, if any, and with little discounting — inspires luxury customers to embrace the brand at full price.

Since late 2017, Burberry has spent more than £700 million, roughly $911 million at today’s exchange rates, on investments to make the brand seem more high end, including expensive store refurbishments. But sales and operating profit at the end of Burberry’s last financial year were only 9% and 1% higher, respectively, than they were six years ago. By comparison, Louis Vuitton’s owner, LVMH, has doubled revenue and almost tripled operating profit over the same time.

The Burberry effort has been a failure, further complicated by alienating its traditional customers, many of whom can no longer afford to buy Burberry.

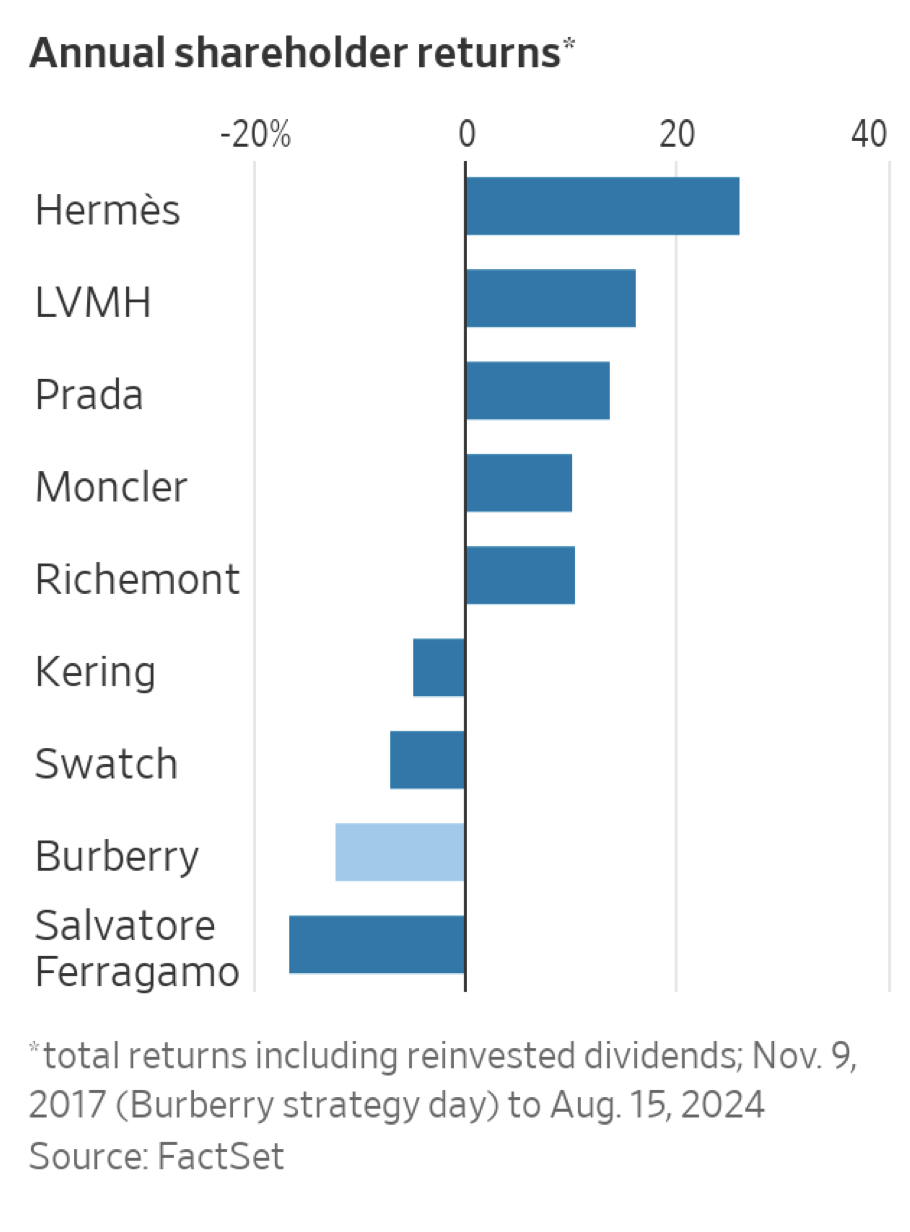

WSJ shares a sobering chart on annual shareholder returns in the period from Nov. 9, 2017 to Aug. 15, 2024.

The shareholder results underscore the precarious position that Kering is in and also begs the question if Ferragamo can truly become more than a shoe brand.

Of all brands under discussion, Burberry is the most reliant on factory stores of all the luxury players. In the thorough WSJ analysis, writer Carol Ryan cites financial stats of 30% of revenues are coming from these off-price stores and up to 60% of net profit.

By contrast, the average comparisons from Burberry’s European rivals is 5% of sales and 10% of profit coming from factory or outlet stores. Remember the practice of burning unsold luxury merchandise that triggered protests in recent years? This is the reason why.

Burberry is between a rock and a hard place, as the saying goes. This is a very sobering analysis about quick-talking, luxury brand-speak and what’s really involved in this complex reboot of trading up in the luxury market.

It’s easy enough to believe that success in the luxury sector is driven by the creative director/designer and creative ad campaigns. Then one studies financial logistics and one understands just how complex it is to make fundamental changes in heritage brands. I believe these are the same challenges that Gucci went through when Tom Ford arrived.